One bad thing about options with compound interest is that they can sometimes cost more than expected. What is the primary drawback of compound interest? Most of the time, the interest on these accounts is added up every day and paid out every month, so the amount of money you make keeps increasing. Interest rates on money market accounts are usually between 1.5% and 2% APY (annual percentage yield). What is a good rate of interest that adds up? In addition to getting returns on the money you invest, you also get returns on those returns at the end of each compounding period, which can be daily, monthly, quarterly, or annually. Why do most banks choose simple interest over compound interest?Ĭompound interest makes money grow faster than simple interest.

COMPOUND DEFINE FINANCE PLUS

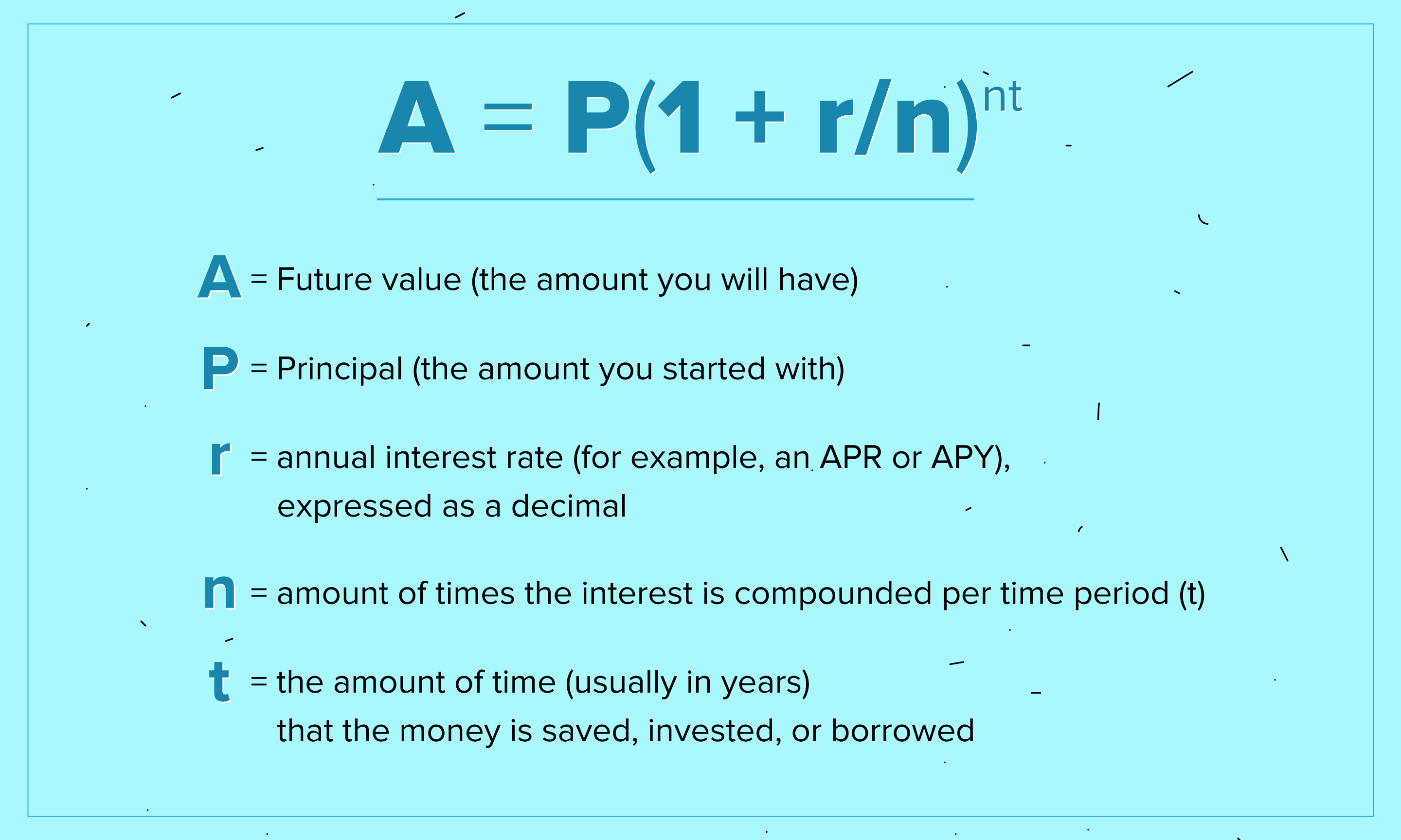

This leaves you with the total amount of the loan plus interest that keeps adding up. Multiplying the loan amount or principal by one plus the annual interest rate by the number of compound periods minus one to figure out compound interest. How do you figure out an interest that is compounded? Depositors also benefit from compound interest when they earn interest on their bank accounts, bonds, or other investments.Įven though the word "interest" is in the phrase "compound interest," it is important to note that the idea goes beyond bank accounts and loans, which are common places where the word "interest" is used.

For example, banks lend money and use the interest they earn to make more loans. For example, if you pay half of your mortgage payment twice a month instead of all of it once a month, you will shorten the time it takes to pay off your loan and save a lot of interest.Ĭompound interest helps investors, although "investors" can mean a wide range of people. Issuers of zero-coupon bonds use the power of compounding to increase the value of the bond so that it is worth its face value when it matures.Ĭompounding can also help you pay off your debts. Instead, they are bought at a discount to their face value, and their value goes up over time. Zero-coupon bonds don't pay investors interest. However, interest does not build up because these payments are made by check. Traditional bond offerings give investors monthly interest payments based on the original terms of the bond issuance. All investments follow the principle of compound interest. Zero-coupon bonds are priced in a way that the price reflects the compounded interest. Even bonds, when invested for the long term, benefit from compounding. SIPs, mutual fund investments, and long-term equity investments all benefit from compounding. When an investor invests for the long-term, he/she benefits from the compounding. Thus, the initial amount gets smaller and smaller as compared to the final amount in the long term. Also, that amount will be Rs 1745 in 30 years. At 10% compounded interest, that amount can become Rs 672 in 20 years. The compounding function works over time. The best way is to let your money grow or pay it off in small amounts over time. If you take out your money, compounding has less of an effect. Your account balance could change if you take money out or put money in. Figure out the break-even point and do the math to see if this will happen. A lower compounding rate can lead to a bigger account balance than a simple calculation, especially over a long period of time. Higher rates lead to faster account growth, but a lower rate can be made up for by compound interest. The interest rate is also a big factor in how much money is in the account over time. Your money compounds over time, and thus the time period is one of the most important factors. Over time, the effects of compounding become more dramatic. Your account can only get interest payments once a month, but calculations are done every day. When you open a savings account, look for one that adds to its balance regularly. For example, the effects of daily compounding are more noticeable. The frequency of compounding is significant. The interest on interest is a powerful tool, and the amount gets compounded very quickly. Recurring payments of interest result in the accumulation of interest. What makes compound interest so powerful? In the second year, the amount will be Rs 121, as the interest on interest is also factored in.

The amount after one year at 10% compound interest, assuming you pay back nothing, will be Rs 110.

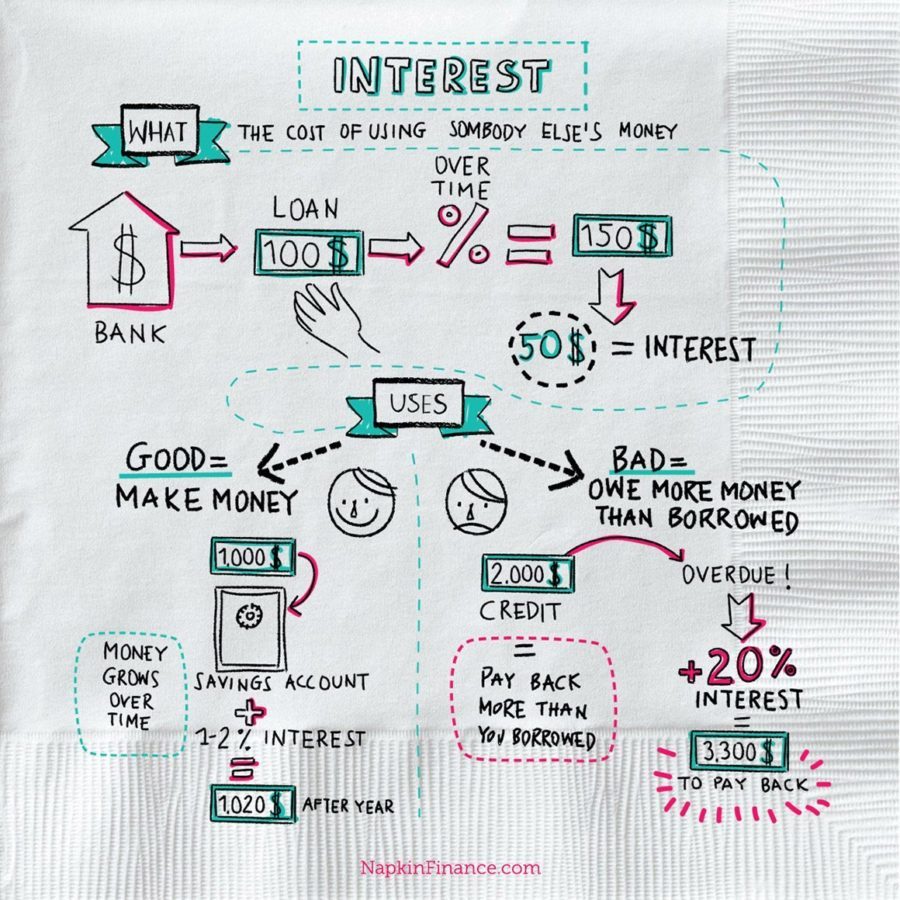

The compound interest rate goes up as the number of times it is added up. The rate at which compound interest is added depends on how often it is added. Compound interest, which is thought to have started in Italy in the 17th century, can be considered "interest on interest." The compound interest gives a higher return as it incorporates the interest on interest as well. Compound interest, also called "compounding interest," is the interest on the initial investment as well as the accrued interest on that investment.

0 kommentar(er)

0 kommentar(er)